Unlocking Financial Acumen: Your Knowledge Hub

At Appalachia Advisors, we believe that empowerment comes from understanding.

The world of finance, while vast, can be navigated with ease when equipped with the right knowledge. Our Learning Center is meticulously curated to provide clarity, simplify complex terms, and present data in a visually engaging manner. Dive deep into our resources and embrace financial literacy like never before.

Financial Glossary: Decoding Jargon

The world of finance is riddled with terms that might seem complex. Our glossary demystifies these terms, providing clear, concise definitions that shed light on their implications.

Journey through a comprehensive A-Z of financial terms. Whether you're a novice investor or a seasoned financial enthusiast, our glossary is your go-to resource for quick references.

Glossary

- Asset Allocation: The process of dividing investments among different kinds of assets (such as stocks, bonds, real estate, and cash) to achieve a desired risk and return profile.

- Capital Gains: The profit realized from the sale of assets like stocks, bonds, or real estate.

- Deferred Tax: Taxes on income that will be paid in a future period, rather than in the current period.

- Diversification: The strategy of spreading investments among different securities or asset classes to reduce risk.

- Fiduciary: A person or organization that acts on behalf of another person or persons to manage assets, bound ethically to act in the other's best interests.

- Index Fund: A type of mutual fund or ETF that aims to replicate the performance of a specific market index.

- Individual Retirement Account (IRA): A tax-advantaged account that individuals use to save and invest for retirement.

- Net Asset Value (NAV): The per-share market value of a mutual fund or ETF.

- Portfolio: A collection of financial investments like stocks, bonds, cash equivalents, mutual funds, and other assets.

- Roth IRA: A type of IRA where contributions are made with after-tax dollars, with tax-free withdrawals in retirement.

- Tax Bracket: The rate at which tax is incurred on an additional dollar of income. Tax brackets result in a progressive tax system, where tax rates increase with increased income.

- Tax Deduction: An expense that can be subtracted from gross income to reduce the amount of income subject to tax.

- Tax-Deferred: Investment earnings such as interest, dividends or capital gains that accumulate tax-free until the investor takes constructive receipt of the profits.

- Time Value of Money (TVM): The concept that money available today is worth more than the same amount in the future due to its potential earning capacity.

- Yield: The income return on an investment, such as the interest or dividends received from holding a particular security.

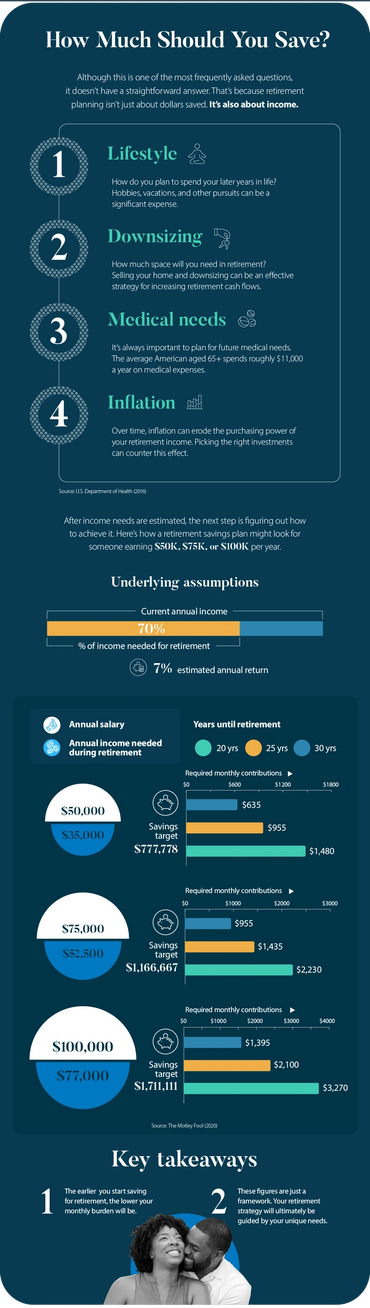

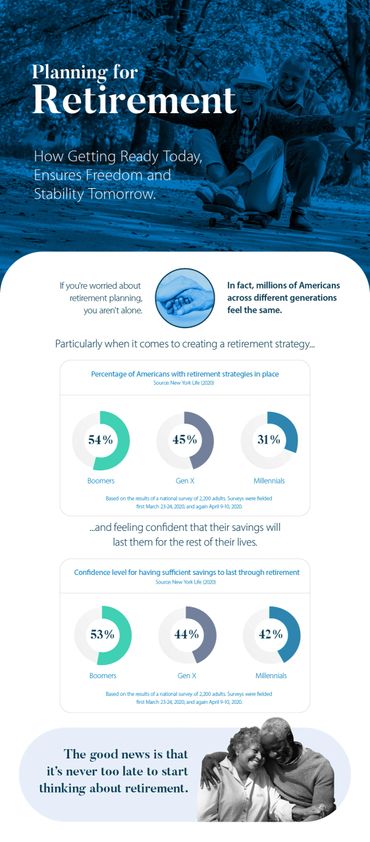

Infographics: Visual Insights for Quick Understanding

Visual learning often simplifies the most complex of topics. Our infographics distill intricate financial concepts into digestible, visual snippets.With our infographics, complex data transforms into visual stories, ensuring a better grasp and retention.

Infographics

SummitSync Inc

We Proudly Accept

We Proudly Accept

Email: SummitSyncinc@outlook.com

Address: 321 NE 2nd Ct, Dania Beach, FL, 33004

Phone: 1(866) 978-4924

We Proudly Accept

We Proudly Accept

We Proudly Accept

Appalachia Advisors

Copyright © 2023 SummitSync INC - All Rights Reserved.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.